- Researchers have built a new platform that produces ultrashort UV-C laser pulses and detects them at room temperature using atom-thin materials. The light flashes last just femtoseconds and can be used to send encoded messages through open space. The system relies on efficient laser generation and highly responsive sensors that scale well for manufacturing. Together, […]

- Researchers have created microscopic robots so small they’re barely visible, yet smart enough to sense, decide, and move completely on their own. Powered by light and equipped with tiny computers, the robots swim by manipulating electric fields rather than using moving parts. They can detect temperature changes, follow programmed paths, and even work together in […]

- New research shows that AI doesn’t need endless training data to start acting more like a human brain. When researchers redesigned AI systems to better resemble biological brains, some models produced brain-like activity without any training at all. This challenges today’s data-hungry approach to AI development. The work suggests smarter design could dramatically speed up […]

- A philosopher at the University of Cambridge says there’s no reliable way to know whether AI is conscious—and that may remain true for the foreseeable future. According to Dr. Tom McClelland, consciousness alone isn’t the ethical tipping point anyway; sentience, the capacity to feel good or bad, is what truly matters. He argues that claims […]

- A new microchip-sized device could dramatically accelerate the future of quantum computing. It controls laser frequencies with extreme precision while using far less power than today’s bulky systems. Crucially, it’s made with standard chip manufacturing, meaning it can be mass-produced instead of custom-built. This opens the door to quantum machines far larger and more powerful […]

- A new AI developed at Duke University can uncover simple, readable rules behind extremely complex systems. It studies how systems evolve over time and reduces thousands of variables into compact equations that still capture real behavior. The method works across physics, engineering, climate science, and biology. Researchers say it could help scientists understand systems where […]

- Spanish researchers have created a powerful new open-source tool that helps uncover the hidden genetic networks driving cancer. Called RNACOREX, the software can analyze thousands of molecular interactions at once, revealing how genes communicate inside tumors and how those signals relate to patient survival. Tested across 13 different cancer types using international data, the tool […]

- BISC is an ultra-thin neural implant that creates a high-bandwidth wireless link between the brain and computers. Its tiny single-chip design packs tens of thousands of electrodes and supports advanced AI models for decoding movement, perception, and intent. Initial clinical work shows it can be inserted through a small opening in the skull and remain […]

- Researchers have built a fully implantable device that sends light-based messages directly to the brain. Mice learned to interpret these artificial patterns as meaningful signals, even without touch, sight, or sound. The system uses up to 64 micro-LEDs to create complex neural patterns that resemble natural sensory activity. It could pave the way for next-generation […]

- Princeton researchers found that the brain excels at learning because it reuses modular “cognitive blocks” across many tasks. Monkeys switching between visual categorization challenges revealed that the prefrontal cortex assembles these blocks like Legos to create new behaviors. This flexibility explains why humans learn quickly while AI models often forget old skills. The insights may […]

- Electrons can freeze into strange geometric crystals and then melt back into liquid-like motion under the right quantum conditions. Researchers identified how to tune these transitions and even discovered a bizarre “pinball” state where some electrons stay locked in place while others dart around freely. Their simulations help explain how these phases form and how […]

- Aalto University researchers have developed a method to execute AI tensor operations using just one pass of light. By encoding data directly into light waves, they enable calculations to occur naturally and simultaneously. The approach works passively, without electronics, and could soon be integrated into photonic chips. If adopted, it promises dramatically faster and more […]

- Researchers have created a prediction method that comes startlingly close to real-world results. It works by aiming for strong alignment with actual values rather than simply reducing mistakes. Tests on medical and health data showed it often outperforms classic approaches. The discovery could reshape how scientists make reliable forecasts.

- USC researchers built artificial neurons that replicate real brain processes using ion-based diffusive memristors. These devices emulate how neurons use chemicals to transmit and process signals, offering massive energy and size advantages. The technology may enable brain-like, hardware-based learning systems. It could transform AI into something closer to natural intelligence.

- More screen time among children and teens is linked to higher risks of heart and metabolic problems, particularly when combined with insufficient sleep. Danish researchers discovered a measurable rise in cardiometabolic risk scores and a metabolic “fingerprint” in frequent screen users. Experts say better sleep and balanced daily routines can help offset these effects and […]

- Researchers at Tsinghua University developed the Optical Feature Extraction Engine (OFE2), an optical engine that processes data at 12.5 GHz using light rather than electricity. Its integrated diffraction and data preparation modules enable unprecedented speed and efficiency for AI tasks. Demonstrations in imaging and trading showed improved accuracy, lower latency, and reduced power demand. This […]

- A wireless eye implant developed at Stanford Medicine has restored reading ability to people with advanced macular degeneration. The PRIMA chip works with smart glasses to replace lost photoreceptors using infrared light. Most trial participants regained functional vision, reading books and recognizing signs. Researchers are now developing higher-resolution versions that could eventually provide near-normal sight.

- Researchers at the University of Surrey developed an AI that predicts what a person’s knee X-ray will look like in a year, helping track osteoarthritis progression. The tool provides both a visual forecast and a risk score, offering doctors and patients a clearer understanding of the disease. Faster and more interpretable than earlier systems, it […]

- UMass Amherst engineers have built an artificial neuron powered by bacterial protein nanowires that functions like a real one, but at extremely low voltage. This allows for seamless communication with biological cells and drastically improved energy efficiency. The discovery could lead to bio-inspired computers and wearable electronics that no longer need power-hungry amplifiers. Future applications […]

- Vast amounts of valuable research data remain unused, trapped in labs or lost to time. Frontiers aims to change that with FAIR² Data Management, a groundbreaking AI-driven system that makes datasets reusable, verifiable, and citable. By uniting curation, compliance, peer review, and interactive visualization in one platform, FAIR² empowers scientists to share their work responsibly […]

AI News

- Dividend growth stocks offer attractive returns and less risk, per Nuveenby Dylan D. Davis

Investors are likely to see some market turbulence in 2026, but the addition of dividend growth companies can help cushion their portfolios. “Bouts of volatility, such as those sparked by macro-, geopolitical- and policy uncertainty, as well as periodic shifts in sentiment around [artificial intelligence] are likely to remain a feature of equity markets,” Nuveen chief investment officer Saira Malik wrote in a recent article . “There may be no surefire cure for hiccups, but history shows that dividend growth companies have yielded higher returns with lower risk than their market peers,” she said, adding that dividends and their growth aren’t guaranteed but their predictability can help mitigate the impact of rocky markets. U.S. common dividend increases on a net basis grew $13.1 billion in the fourth quarter of 2025, compared to $11.7 billion in the year-ago period, according to S & P Dow Jones Indices. “At this point, Q1 2026 is expected to be a very busy positive period for dividend increases, as overall earnings and sales have posted record levels, with 2026 expected to post more records,” said Howard Silverblatt, senior index analyst at S & P Dow Jones Indices. S & P 500 stocks are expected to see mid-single-digit dividend increases in the new year as companies grapple with uncertainty and the rapid pace of policy change, he added. CNBC Pro screened the Vanguard Dividend Appreciation ETF (VIG) to turn up dividend growers that are beloved by Wall Street. Fifth Third Bancorp emerged on the list. Shares have jumped almost 18% in the past 12 months, and the stock has a current dividend yield of 3.25%. In September, the Cincinnati-based super regional bank raised its cash dividend 8% , lifting the quarterly payment to 40 cents a share. UBS analyst Erika Najarian this week upgraded Fifth Third to buy, dubbing it “best-in-class in both growth and profitability” with additional opportunities stemming from its pending acquisition of Comerica for some $11 billion in stock. “While we see regionals catching up in ’26 in a major way, we think investors will be selective in how they express this strategy,” Najarian wrote. “FITB fits the profile long-term investors desire: management team with strong credibility, above-peer prospects in high-growth markets and best-in-class profitability.” FITB 1Y mountain Fifth Third Bancorp in the past 12 months Coca-Cola is another reliable dividend grower. Shares are up more than 12% in the past 12 months, and Atlanta-based soft drink maker pays a current dividend yield of 3.0%. The stock appeared this week on Wells Fargo’s list of overweight tactical ideas for the first quarter. “We see prospects for accelerating volume over the course of 2026 against easy comps, building confidence in durability of top-line growth long term, with visibility on margins, partly helped by positive currency tailwinds,” analyst Chris Carey wrote. The Sprite and Fanta maker is expected to benefit from the World Cup this summer, too, he said. Coca-Cola lifted its quarterly dividend for the 63rd consecutive year last February, raising it more than 5% to 51 cents per share. KO 1Y mountain Coca-Cola in the past 12 months Other names that showed up on CNBC Pro’s screen include biopharmaceutical player AbbVie , data center power stock Entergy and insurer Unum Group . —CNBC’s Michael Bloom and Fred Imbert contributed reporting.

Source link - Canadian pharmacy platform to offer India-sourced Ozempic to US patientsby Dylan D. Davis

- Truebit Token Price Falls 99% after Reports of $26M Exploitby Dylan D. Davis

The TRU price fell to $0.0000000029 from $0.16 after the protocol reported a security incident and crypto sleuths tracked stolen Ether.

The Truebit protocol reported a security incident “involving one or more malicious actors” with a smart-contract address suggesting the loss of $26 million worth of Ether.

In a Thursday X post, Truebit said it was in contact with law enforcement and “taking all available measures” following the security incident. Crypto sleuths monitoring the protocol reported that the exploit had resulted in the removal of 8,535 Ether (ETH), worth about $26.6 million at the time of publication.

Source: Truebit The affected smart contract address provided by Truebit showed only small amounts of ETH stolen. However, analysis from Lookonchain and other sleuths signaled that the total amount of crypto stolen in the attack was worth more than $26 million.

It’s unclear what led to the multimillion-dollar exploit or whether user funds were at risk. Cointelegraph reached out to Truebit for comment on the incident, but had not received a response at the time of publication.

Related: Gnosis announces hard fork to recover funds from Balancer exploit

Almost immediately following reports of the exploit, the price of the Truebit (TRU) token plummeted to an all-time low. According to data from Nansen, the TRU price fell more than 99% to $0.0000000029 from about $0.16 at the time of writing.

Truebit hack follows major exploits in 2025

December saw several significant hacks and exploits resulting in millions of dollars worth of digital assets stolen.

The Flow Foundation reported that an attacker had managed to counterfeit tokens on the network on Dec. 27, resulting in about $3.9 million in losses. Hackers also targeted Trust Wallet’s Chrome browser extension using a malicious update to steal $7 million.

Despite these incidents, blockchain analytics platform PeckShield reported on Jan. 1 that the total losses across the crypto industry due to exploits and hacks dropped to $76 million in December from $194 million in November .

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Source link - Stephanie Link says this oil stock is cheap and poised to benefit from the data center boomby Dylan D. Davis

Hightower’s Stephanie Link is buying shares of SLB because she believes the world’s largest oilfield services company is a hidden artificial intelligence beneficiary and the stock is cheap. “SLB is one of my favorite stocks for 2026,” said Link in the exclusive video. “I think organic growth for the industry is going to improve this year and in the coming years. And this is tied to power demand. And this is tied to anything AI, data center buildout and grid repair.” SLB shares are off to a hot start to 2026, gaining 14 precent so far this year and touching their highest levels in more than 14 months this week. The stock is getting a boost from President Donald Trump’s takeover of oil resources in Venezuela, which some investors believe will lead to more demand for companies like SLB that aid in getting oil out of the ground. The stock is still down by more than half from all-time highs reached more than a decade ago. SLB 1Y mountain SLB shares, 1 year But Link’s bullishness is not tied to the Venezuela narrative, it’s about a company that’s taken steps to improve profitability which are not yet appreciated by the market. And it has an AI tailwind to boot. Here’s Link’s full analysis: “SLB is one of my favorite stocks for 2026. I like it for two reasons. One, from the macro point of view, I think the industry is set to see a recovery this year and over the next couple of years. And number two, for company specific fundamentals tied to SLB.” “So let’s start with the macro. I think organic growth for the industry is going to improve this year and in the coming years. And this is tied to power demand. And this is tied to anything AI, data center buildout and grid repair. We know we need power for all of this. We don’t have enough of it. And I think the oil field services companies will benefit.” “Number two, I think international activity is set for an inflection higher in the second half of 2026. And a lot of that is because U.S. shale is actually maturing. But number two, Middle East is expected to see substantial capex improvement on a year over year basis, up 6% versus down 1% year over year.” “And of course, the IOCs (integrated oil companies) wanna partner with the oilfield services companies. SLB is the best of the best.” “So five fundamental reasons why I like SLB: Number one, if I’m right on international recovery, these guys will benefit because international is 81% of their revenues. Number two, they are industry leader with double digit revenue growth and EBITDA margins. Number three, they have a digital solutions business, which is a real differentiator. They have a suite of AI products that help their customers be more efficient and more productive. That gives SLB pricing power. So I expect margins to go higher and revenues to go higher. And oh by the way, recurring revenue also should improve. In the third quarter of last year, the company actually posted almost a billion dollars in recurring revenue on a trailing 12-month basis, just from this business alone. So that’s pretty synergistic. Number four, they made an acquisition of ChampionX a couple of months ago. They should see $400 million in synergies. And oh, by the way, that business [is] a little less cyclical, which I like. Number five, we should see about $4 billion of shareholder returns in buybacks and dividends this year on top of last year.” “So you get all of this for 15 times earnings and 8.6 times EBITDA. And the stock is still down 30 % from its 2023 highs. So I think there could be some mean reversion as well.”

Source link - Temple Digital Group Launches Institutional Trading Platform on Cantonby Dylan D. Davis

Temple Digital Group has launched a private, institutional trading platform built on the Canton Network, offering continuous, 24/7 trading of digital assets using a central limit order book and non-custodial market structure.

According to an announcement shared with Cointelegraph on Thursday, the platform supports trading in cryptocurrencies and stablecoins and is designed to allow institutions to transact with approved counterparties while maintaining privacy and regulatory oversight, with participants retaining custody of assets rather than relying on a central intermediary.

The system is built around a price-time priority central limit order book with sub-second matching and includes execution monitoring and transaction cost analysis tools intended for institutional trading desks, the company said.

The platform is live and onboarding institutional users, including asset managers, market makers and financial institutions, with support for tokenized equities and commodities planned for 2026.

Top blockchains for tokenized real-world assets. Source: RWA.xyz Temple Digital Group is a New York–based digital asset infrastructure company that builds non-custodial trading infrastructure for institutional digital asset markets.

The Canton Network is a permissioned blockchain created by Digital Asset that allows regulated institutions to transact and settle tokenized assets onchain.

Related: Digital Asset raises fresh funding to scale Canton Network adoption

Institutional adoption accelerates on the Canton Network

The Canton Network drew increased institutional attention in late 2025, as companies announced new deployments involving tokenized funds, collateral and financing infrastructure.

In December, Franklin Templeton expanded its Benji tokenization platform to Canton, allowing its tokenized US government money market fund to be used as collateral within Canton’s institutional ecosystem. The fund held $828 million in assets at time of writing, according to industry data.

Tokenized US Treasury Funds. Source: RWA.xyz On Dec. 9, Canton Network’s creator, Digital Asset, and a group of major financial institutions completed a second round of onchain US Treasury financing on Canton. The trial showed that tokenized Treasurys can be reused as collateral in real time, highlighting how blockchain-based infrastructure can reduce frictions in traditional collateral and financing markets.

About a week later, the Depository Trust and Clearing Corporation (DTCC) said it plans to mint a subset of US Treasury securities on the Canton Network, extending blockchain-based settlement into market infrastructure that processed $3.7 quadrillion in transactions in 2024.

On Wednesday, Digital Asset and Kinexys by JPMorgan announced plans to bring JPMorgan’s US dollar deposit token, JPM Coin, natively onto the network.

The Canton Coin (CC) has risen sharply recently. It is up more than 40% over the past two weeks and more than 80% over the past month, according to CoinGecko data at the time of writing.

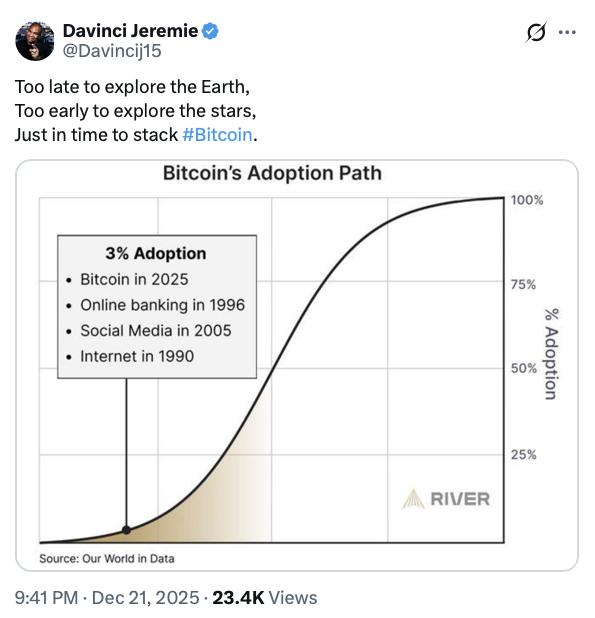

Source: CoinGecko Magazine: Davinci Jeremie bought Bitcoin at $1… but $100K BTC doesn’t excite him

Source link - These stocks are going to see the biggest revenue boostby Dylan D. Davis

Trivariate CEO and founder, wrote in a note to clients. “One of the biggest investment controversies for U.S. equities is the return on AI-related capital spending,” Parker wrote. “More growth companies and high-quality companies are mentioning AI-related revenue and cost-reduction topics on their conference calls than value or lower quality stocks.” Trivariate named the largest 15 stocks in the S & P 500 that mentioned AI use cases on their 2025 earnings calls in more than three revenue growth categories, including AI offerings and infrastructure monetization, monetization optimization and innovation and research and development acceleration. Forecast revenue growth is highest for companies that are seeing proven returns on AI offerings and infrastructure monetization, especially those that sell AI (through models, data products, AI-enabled services, chips and networking) where AI is the revenue product, Parker said. These were some of the stocks named by Trivariate: Shopify turned up on the screen for AI stock ideas seeing revenue growth. The company has forecast revenue growth of nearly 33%. Shopify management touted the data analysis abilities of its AI-powered commerce assistant for merchants, called Sidekick, during 2025 earnings calls. The Canadian internet infrastructure provider also launched Universal Cart last year, an AI-powered feature that allows shoppers to track items from multiple stores on one platform, and partnered with OpenAI to allow users to make purchases through ChatGPT. “We’re actively working on new opportunities and partnerships because we think that helping our merchants thrive wherever customers are, is very important … We have great relationships with all the AI companies, and we’ll continue to work with them,” Shopify president Harley Finkelstein said on the company’s second-quarter earnings call last year. Shares of Shopify traded in the U.S. have rallied more than 54% over the past year, lifted by Wall Street’s enthusiasm for its AI partnerships. ServiceNow also made the AI revenue screen. The company saw its shares plummet 30% over the past year, partly due to concern over its reported interest in acquiring security startup Armis. Still, Trivariate is bullish on the Silicon Valley workflow automation platform’s AI-led revenue growth. ServiceNow is forecasting revenue growth of nearly 24%. ServiceNow has been a leader in adopting agentic AI across its company’s functions. ServiceNow CEO William McDermott said on its second-quarter earnings call last year that its had 450,000 agents operating across its workflow, with over 80% of the work for support functions, such as customer support and compliance, being done by agents. “Agentic is real. The business cases are extraordinary … It’ll be $350 million value to us this year,” McDermott said. “We think it might even be more,” at least if happiness and productivity are added to the mix, he said. “If you just think about the sales curve, for example, it’s a 50% improvement in sales productivity, not to have to do the setup work.” Other companies that made Trivariate’s screen for long AI revenue ideas were Google parent Alphabet , Adobe and Meta Platforms .

Source link - Morgan Stanley to launch digital asset wallet as part of crypto product expansionby Dylan D. Davis

Morgan Stanley has plans to launch a digital asset wallet in 2026 as the financial services giant continues expanding its crypto investment product offerings to clients.

The wallet is built to support cryptocurrencies and real-world tokenized assets (RWAs), including stocks, bonds and real estate, with plans to support more assets over time, according to Barron’s.

In September, the company announced that it would allow users of the E*Trade brokerage platform, which it owns, to trade cryptocurrencies including Bitcoin (BTC), Solana (SOL) and Ether (ETH) in 2026.

The total value of tokenized real-world assets is broken down by asset class. Source: RWA.XYZ Cointelegraph reached out to Morgan Stanley for comment but had not received a response at time of publication.

The announcements show that crypto and blockchain technology are gaining widespread adoption from established financial institutions in the traditional finance world.

Related: Morgan Stanley’s Bitcoin ETF could offer strategic value beyond inflows, analysts say

Morgan Stanley pushes further into cryptosphere

Morgan Stanley announced several crypto-related developments for 2026, including several crypto exchange-traded fund (ETF) filings.

The company filed applications with the US Securities and Exchange Commission (SEC) on Tuesday to issue spot BTC and SOL ETFs, which would be “passive” investment funds tracking the spot price of these cryptocurrencies by holding them.

Morgan Stanley also filed for a staked Ether ETF on Tuesday that would hold spot ETH while staking an undisclosed portion of the fund’s ETH to earn staking income.

Morgan Stanley’s S-1 form for an Ethereum ETF. Source: SEC Staking is the process of pledging or locking up tokens to secure proof-of-stake blockchain networks, which can either be done directly as a validator processing transactions or through third-party delegation with a staking services provider.

Users who stake tokens are paid in the token of the blockchain they are securing — not fiat currencies or stablecoins.

Morgan Stanley initially offered crypto investment products to wealthy clients with at least $1.5 million in investible assets. In October, the company pivoted to allow all clients to invest in crypto products.

The company began recommending “conservative” crypto allocations in October. Morgan Stanley analysts recommended up to a 4% allocation for higher risk portfolios geared toward growth and a 2% allocation for “balanced risk” portfolios.

Magazine: Solana vs Ethereum ETFs, Facebook’s influence on Bitwise: Hunter Horsley

Source link - Exclusive-Big Tech spared strict rules in EU digital rule overhaul, sources sayby Dylan D. Davis

- Some of Warner Bros’ biggest investors are split on Paramount offerby Dylan D. Davis

- Czech defense firm CSG plans IPO in Amsterdam next week – Bloombergby Dylan D. Davis

- CrowdStrike to buy identity security startup SGNL for $740 million to tackle AI threatsby Dylan D. Davis

- Alibaba, Costco among market cap stock movers on Thursdayby Dylan D. Davis

- Brazil 2025 eggs exports soar on strong US demandby Dylan D. Davis

- Exclusive-Trump, Congress move to undo Biden-era ban on mining in northern Minnesotaby Dylan D. Davis

- What they’re buying in 2026 after strong yearby Dylan D. Davis

Various Halliburton equipment being stored at the equipment yard in Alvarado, Texas.

Cooper Neill | Reuters

Fresh off a bumper 2025, retail investors are rushing back into the market with a focus on energy stocks.

Everyday traders bought at the second-highest level in almost eight months at the start of 2026’s trading year, according to a JPMorgan report released Wednesday. Oil-related stocks were a particularly hot pick for mom-and-pop investors following the U.S.’ weekend strike on Venezuela, data shows.

“Retail investors favored some of the companies that can immediately profit from the potential return of Venezuelan heavy crude to the [U.S] or those needed to rebuild the country’s decaying oil infrastructure,” Arun Jain, JPMorgan’s quant analyst, told clients.

Net daily retail inflows into Halliburton spiked to the highest level since early 2022, according to market research firm VandaTrack. Flows into Chevron — which Wall Street quickly crowned a key beneficiary of the military intervention — hit highs going back to summer, the firm found.

Beyond those stocks, JPMorgan found surging retail inflows into fellow oil industry stalwarts such as Baker Hughes and SLB as investors wondered what’s next for the global industry.

Venezuela sits on the largest proven crude oil reserves in the world, but output has dropped significantly from its peak in the late 1990s. President Donald Trump said the South American country would ship up to 50 million barrels of oil to U.S. following the strike. American forces captured Venezuelan President Nicolás Maduro and his wife and brought them to the U.S. on drug trafficking charges.

To be sure, it’s not yet clear if these big bets from average-Joe traders in the wake of the Venezuela action will pay off long term. Halliburton, SLB and Baker Hughes shares have jumped this week, while Chevron has whipsawed following a big Monday rally.

Stock Chart Icon Stock chart iconOil stocks over the last five days

But pullbacks don’t necessarily mean retail traders will abandon the theme, according to Viraj Patel, deputy head of research at Vanda. If oil plays out for these investors like the popular artificial intelligence trade, they will likely hang around for the ride.

“Once retail gets its teeth into a theme, they don’t let go — like a dog with a bone,” Patel said. “AI showed us that if retail believes in something, they’ll keep buying even on bad days.”

This interest in energy can also signal a shift away from high-growth names to those with more cash flow generation, according to Patel. Retail trading also picked up for oil-focused exchange-traded funds like the State Street Energy Select Sector SPDR ETF (XLE), he said.

Retail’s next test

Energy could mark the latest test for a group whose strong performance last year is creating a narrative shift among big investors.

JPMorgan’s Jain reported record retail flows in 2025, with everyday investors rushing into the SPDR Gold Shares (GLD) fund and AI stocks like Nvidia and Palantir — all of which rallied sharply. Overall annual inflows were close to double the five-year average and almost 60% higher than in 2024, per the bank’s data.

Retail traders’ jump into equities to start the new year follows a seasonal slowdown in the last week of 2025, Jain added.

Small investors bought the dip successfully at early points in the year, allowing them to ride the market’s dramatic midyear rebound to all-time highs, according to Vanda and JPMorgan. Because of that, their reputation has moved away from the “dumb money” caricature defined by meme stock surges and short squeezes toward a one of more mature market participant.

“Institutional investors are no longer asking how to fade retail,” Patel said. “They’re asking, ‘What are they seeing that we’re not?'”

Read more CNBC reporting on retail investors

Source link - Earnings call transcript: PriceSmart misses EPS but beats on revenue in Q1 2026by Dylan D. Davis

- Regional banks are well set up entering 2026, with one set to be a big winner, says Jay Woodsby Dylan D. Davis

Earnings season kicks off next week, led by the big banks and followed by their smaller brethren – the regionals. Our CNBC Pro friends Josh Brown and Sean Russo wrote a great piece about two regional banks ready to move in 2026 in PNC and Fifth Third Bancorp – I concur wholeheartedly and think there’s an even bigger play in the sector. Technically speaking, the patterns we see forming in the regional banks are quite similar to recovery trends we saw in the overall market as we recouped from 2022’s drop in 2023 only to truly breakout and run higher in 2024. The SPDR S & P Regional Banking Index (KRE) has almost made a full recovery from the 2022 bear market. Despite a solid performance last year, the regionals continue to lag and are just starting to get out of the 2023 crisis created by the collapse of Silicon Valley Bank. To kick off 2026, the regionals are starting to make their move. While the KRE is a safer and more diversified way of playing the sector — and seems poised for a breakout as seen in this five-year weekly chart above — I think there is more reward to pick the winners in this sector individually. My pick is Regions Financial (RF) . Based in Birmingham, Alabama, Regions is one of the dominant players in the fastest growing area of the U.S. — the southeast. Fundamentally, they have surpassed EPS expectations the past six quarters thanks to consistent growth in net interest income and rising profits. They, like the entire financial sector, continue to have a strong tailwind behind them. With less regulatory red tape there has been more M & A activity in the sector and Regions themselves at a $25 billion valuation could be a desirable dance partner for a larger bank looking to make deep inroads into the southeast. Technically, the risk/reward setup is appetizing. Let’s look at the charts on multiple time frames to demonstrate. On a one-year daily chart, we broke out to new 52-week highs after clearing a strong resistance area at the $27 level. While a pullback is possible as we head into next week’s earnings, look for the old resistance level to act as new support before resuming its upward trajectory. Momentum indicators in both the RSI and MACD are trending higher as well. This also shows there is room to run higher. Look for a push to $32 over the next quarter on good results. Then there’s the big picture. Let’s put this in an even larger perspective. I’m old enough to remember the 2007-2009 Great Financial Crisis vividly. I like to go back and examine the damage done. Some of the major banks and a handful of regionals have never eclipsed their old pre-GFC levels. Others are getting close. Regions is one of them as seen in this 20-year monthly chart. The launch pad seems set for Regions to return to its prior heights. We have a breakout to start the year, momentum in the sector and the hope of continued strong earnings. This set-up gives us an achievable upside target of $38 over the next 12 months with downside risk parameters that are far less than the potential rewards. — Jay Woods, CMT with Chase Games DISCLOSURES: None. All opinions expressed by the CNBC Pro contributors are solely their opinions and do not reflect the opinions of CNBC, or its parent company or affiliates, and may have been previously disseminated by them on television, radio, internet or another medium. THE ABOVE CONTENT IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY . THIS CONTENT IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSITUTE FINANCIAL, INVESTMENT, TAX OR LEGAL ADVICE OR A RECOMMENDATION TO BUY ANY SECURITY OR OTHER FINANCIAL ASSET. THE CONTENT IS GENERAL IN NATURE AND DOES NOT REFLECT ANY INDIVIDUAL’S UNIQUE PERSONAL CIRCUMSTANCES. THE ABOVE CONTENT MIGHT NOT BE SUITABLE FOR YOUR PARTICULAR CIRCUMSTANCES. BEFORE MAKING ANY FINANCIAL DECISIONS, YOU SHOULD STRONGLY CONSIDER SEEKING ADVICE FROM YOUR OWN FINANCIAL OR INVESTMENT ADVISOR. Click here for the full disclaimer.

Source link - Coincheck Group to Acquire Digital Asset Manager 3iQ in $112M Stock Dealby Dylan D. Davis

Coincheck Group, the Nasdaq-listed holding company behind one of Japan’s largest cryptocurrency exchanges, has agreed to acquire a 97% stake in Canadian digital asset manager 3iQ from its majority owner, Monex Group.

The stock-purchase transaction values 3iQ at $111.84 million, using Coincheck Group shares priced at $4 each. Coincheck Group said it intends to offer the same terms to 3iQ’s minority shareholders, which would give it full ownership if the deal is completed.

The deal is expected to close in the second quarter, subject to regulatory approvals and other customary conditions.

Founded in 2012, 3iQ is a Canada-based digital asset manager that provides regulated cryptocurrency exposure through traditional investment products. The company was an early entrant in exchange-listed crypto funds and later expanded into staking-based exchange-traded funds (ETFs) and managed crypto strategies primarily for institutional investors.

Coincheck is a Japan-based cryptocurrency exchange launched in 2014 that offers regulated retail trading and custody services. In December 2024, it became the first Japanese cryptocurrency exchange to list on the Nasdaq.

According to the announcement, the 3iQ deal follows Coincheck Group’s recent expansion through acquisitions, including its October purchase of Paris-based crypto prime broker Aplo SAS and its March acquisition of staking services provider Next Finance Tech Co., as the company builds out its institutional and international operations.

Related: Binance acquires regulated crypto exchange in Japan

US-based crypto exchanges make acquisitions

Recent acquisitions by Coincheck reflect a broader effort by crypto exchanges to diversify revenue beyond trading fees and expand into adjacent businesses.

In 2025, US-based exchange Coinbase made several acquisitions spanning infrastructure, consumer products and derivatives.

Early in the year, the exchange acquired Spindle, a blockchain-based advertising platform, and the team behind Roam, a Web3-focused browser. In July, Coinbase bought Liquifi, a platform used by early-stage token projects to manage compliance and token distribution.

Coinbase agreed in May to acquire Deribit for $2.9 billion, one of the largest deals in the sector, expanding its global derivatives business. To close the year, the company acquired The Clearing Company, adding onchain prediction markets to its product offerings.

Kraken also made several acquisitions in 2025, buying futures trading platform NinjaTrader in May to expand into traditional derivatives for US customers, followed by the August purchase of Capitalise.ai, a no-code trading automation startup.

In December, the company agreed to acquire Backed Finance AG, bringing tokenized equities issuance and settlement into its product suite.

Source: RWA.xyz Magazine: Davinci Jeremie bought Bitcoin at $1… but $100K BTC doesn’t excite him

Source link - Northern Technologies earnings beat by $0.02, revenue topped estimatesby Dylan D. Davis

- Northrop Grumman launches digitally enhanced ICBM target vehicleby Dylan D. Davis

- BlackRock Buys $900M BTC as Long-Term Selling Hits 2017 Lowsby Dylan D. Davis

BlackRock’s fresh round of Bitcoin (BTC) buying takes place alongside a sharp slowdown in long-term selling, a combination that points to cooling downside pressure after the recent market pullback in Q4.

Key takeaways:

BlackRock added nearly $900 million worth of Bitcoin in the first week of January, rebuilding exposure after an end-of-2025 drawdown.

Long-term Bitcoin holders are selling at their lowest rate since 2017, despite elevated prices.

Onchain data pointed to a possible accumulation phase among certain wallet cohorts.

Data from Lookonchain indicated BlackRock has accumulated Bitcoin for the past three days, adding 9,619 BTC valued at roughly $878 million. The asset management company currently holds about 780,400 BTC, worth $70 billion.

BlackRock’s BTC holdings. Source: Arkham Intelligence BlackRock’s BTC holdings peaked on Nov. 30 at around 804,000 BTC. At the time, that position was valued at roughly $96.5 billion. Although holdings fell to 771,000 BTC by Jan. 1, BlackRock has swiftly added close to 9,000 BTC during the first week of January.

The institutional buying coincided with a notable shift among long-term holders. Bitcoin’s Exchange Inflow Coin Days Destroyed (CDD) metric on Binance has fallen to its lowest level since 2017, signaling that older coins are barely moving onto exchanges.

Bitcoin exchange inflow CDD on Binance. Source: CryptoQuant For context, long-term holder supply dropped from over 15 million in July 2025 to 13.6 million in November 2025. Over the past couple of months, the long-term supply has not decreased further.

Signs of BTC accumulation as recent sellers step aside

Onchain data from CryptoQuant helps explain this shift. The SOPR Ratio, which broadly compares whether recent buyers and long-term holders are selling at a profit or loss, has dropped to levels associated with market resets. Newer participants are selling at losses, while long-term holders remain profitable and largely inactive.

Bitcoin SOPR LTH-STH dynamics. Source: CryptoQuant This pattern reflects a clean-up phase after sharp rallies, where speculative positions unwind, and coins change hands at lower prices. With Bitcoin down roughly 20% to 25% from its highs, this dynamic can mark the early stages of accumulation, provided selling pressure from recent buyers continues to drop.

Related: Morgan Stanley’s Bitcoin ETF could offer strategic value beyond inflows, analysts say

Bitcoin’s unrealized profit/loss data points to a reset

Bitcoin’s Net Unrealized Profit/Loss (NUPL) added another layer of context. The metric currently sits near the 0.3 level, a zone that has historically marked transitions from recovery into more constructive market conditions. Holders, on average, are back in moderate profit, but the market remains far from the excess seen near major cycle tops.

Bitcoin net unrealized profit/loss. Source: CryptoQuant This positioning suggests a cautious transition phase rather than a clear breakout. Confidence appears to be rebuilding, but broader confirmation on both onchain and market structure would be needed before a stronger move.

Related: Bitcoin averages 100% return after down years: Will the pattern repeat in 2026?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Source link - Buda Juice shares surge 60% in NYSE American debutby Dylan D. Davis

- Earnings call transcript: Commercial Metals beats Q1 2026 earnings forecastby Dylan D. Davis

- Morgan Stanley cuts Ball, sees better earnings revision upside at Crownby Dylan D. Davis

- Snowflake stock falls after announcing acquisition of Observeby Dylan D. Davis

- Earnings call transcript: AZZ Inc. Q3 2026 earnings beat expectationsby Dylan D. Davis

- France stocks higher at close of trade; CAC 40 up 0.12%by Dylan D. Davis

- Why South Korea Can’t Agree on Who Should Issue Stablecoinsby Dylan D. Davis

Key takeaways

Korea’s crypto bill is stalled over stablecoin issuer rules.

The central bank wants banks to remain in control, often framed as a “51%” threshold.

Regulators and lawmakers fear a bank-only model would limit competition.

Firms are lining up, with Toss planning a won-backed stablecoin once rules are finalized.

South Korea’s next major crypto law is being held up by a seemingly simple question: Who gets to issue a won-backed stablecoin?

The proposed Digital Asset Basic Act has slowed as regulators clash over whether stablecoins should be treated as bank-like money or as a licensed digital-asset product.

At the center is the Bank of Korea’s push for a “banks-first” model, ideally through bank-led consortia with at least 51% bank ownership, arguing that stablecoins could, in their view, spill over into monetary policy, capital flows and financial stability if they scale too quickly.

The Financial Services Commission and lawmakers, meanwhile, are wary that a bank-dominated regime could materially limit competition and slow innovation.

The standoff is now expected to push the bill into 2026.

Why Korea cares about won-stablecoins

Stablecoins in South Korea are already important to local traders who move value into crypto markets, often via dollar-pegged tokens to access offshore liquidity. If stablecoin use scales, it could amplify cross-border flows and complicate foreign-exchange management, especially in a market where crypto participation and retail exposure are unusually high.

That is why the Bank of Korea continues to frame issuer rules as a “financial stability” decision. Officials argue that a cautious, staged rollout, starting with tightly regulated banks, reduces the risk of sudden outflows or a loss of control over how “private money” circulates.

At the same time, policymakers who want more companies to be allowed to issue won-backed stablecoins view the issue as one of competitiveness. If Korea does not build a trusted local option, users will continue to rely on foreign stablecoins, leaving the country with less regulatory visibility and fewer opportunities to grow a domestic stablecoin industry.

Did you know? In the 12 months through June 2025, stablecoin purchases denominated in Korean won totaled about $64 billion in South Korea, according to Chainalysis.

The regulatory backdrop

South Korea’s first major crypto regulatory act was the Act on the Protection of Virtual Asset Users. It is built around market safety, including the segregation and custody of customer funds, with banks designated as custodians for user deposits. The framework also mandates cold-wallet storage, criminal penalties for unfair trading and insurance or reserve requirements to cover hacks and system failures.

However, that “phase 1” framework is mainly focused on how exchanges and service providers protect users. The unresolved dispute lies in the next step, the proposed Digital Asset Basic Act, where lawmakers and regulators aim to define stablecoin issuance, supervision and issuer eligibility.

This is precisely where the bill is bogging down. When Korea tries to answer the question of who can issue stablecoins, the Bank of Korea and the financial regulator diverge.

Did you know? South Korea’s crypto rules require licensed service providers to keep at least 80% of customer assets in offline cold wallets to protect against hacks and theft.

Three institutions, three incentives

South Korea’s stablecoin standoff is ultimately a dispute over which institution should have primary responsibility when private money becomes systemically important.

The Bank of Korea is approaching won-backed stablecoins as a potential extension of the payments system and, therefore, as a monetary policy and financial stability issue. Its senior leadership has argued for a gradual rollout that begins with tightly regulated commercial banks and only later expands to the broader financial sector to reduce the risk of disruptive capital flows and knock-on effects during periods of market stress.

The Financial Services Commission views the same product as a regulated financial innovation that can be supervised through licensing, disclosure, reserve standards and ongoing enforcement, without hard-wiring the market to banks as the default winners.

That is why the FSC has pushed back against the idea that issuer eligibility should be determined mainly by ownership structure and why leaked and proposed approaches have reportedly examined multiple models rather than treating bank control as the only safe option.

Then there are lawmakers and party task forces, who are weighing political promises, industry pressure and the optics of competitiveness.

Some proposals have contemplated relatively low capital thresholds for issuers, which the central bank has described as increasing instability risks. Others argue that a bank-first regime could simply delay product market fit and push activity toward offshore dollar stablecoins.

Even the “51% rule” debate has a local twist. The Bank of Korea has warned that allowing non-bank corporates to take the lead could collide with Korea’s long-standing separation between industrial and financial capital.

Did you know? Major Korean exchanges such as Bithumb and Coinone added USDT/KRW trading pairs starting in December 2023, making stablecoins easier to access directly with the won.

The “51% rule”: What it is, why it exists and why it’s controversial

In its strictest form, the Korean media-dubbed “51% rule” suggests that a won-backed stablecoin issuer should be a consortium led by commercial banks, with banks holding at least a 51% ownership stake. This structure would effectively ensure that banks control governance, risk management and, crucially, redemption operations.

The logic is that if stablecoins begin functioning like money at scale, they can influence monetary policy transmission, capital flows and financial stability. A bank-led structure is intended to import prudential discipline from day one, including capital standards, supervisory culture, Anti-Money Laundering (AML) controls and crisis management, rather than attempting to bolt those safeguards on after a non-bank issuer has already reached systemic size.

The opposition is just as direct. The Financial Services Commission and pro-industry lawmakers argue that hard-wiring bank control into the rules could reduce competition, slow experimentation and effectively shut out capable fintech or payments firms that might deliver better distribution and user experience.

Critics also point out that mandatory ownership thresholds are an indirect way to regulate risk and not the only one, given the availability of reserve requirements, audits, redemption rules and supervisory powers.

It’s not just about who issues stablecoins

Even if South Korea ultimately allows non-banks to issue won-backed stablecoins, regulators still have plenty of levers to prevent the product from exhibiting shadow-bank-like risk characteristics.

The government’s draft approach has focused on reserve quality and segregation, steering issuers toward highly liquid, low-risk backing such as bank deposits and government debt. Reserves would be held through third-party custody and structurally separated from the issuer to reduce bankruptcy spillover.

Then there is the “money-like” principle of quick redemption at par. Publicly discussed proposals include clear redemption rules and tight timelines, which are designed to prevent a stablecoin from turning into a gated fund during periods of market stress.

Korea’s broader regulatory posture already points in this direction. The Financial Services Commission has been building a user-protection regime around custody standards and strict operational requirements, such as offline storage thresholds for customer assets, showing that regulators are comfortable setting concrete technical guardrails rather than relying solely on licensing decisions.

Industry pressure and what to watch in 2026

There is urgency. The regulatory standoff is unfolding while the market is already preparing for won-backed stablecoins.

Major commercial banks are gearing up for a bank-led model, while large consumer platforms and crypto-native players are exploring how they could issue or distribute a won-pegged token if the rules allow it. Multiple banks and major companies are reportedly positioning for this market even as the policy debate drags on.

Fintech firms, however, do not want to operate inside a bank-controlled consortium. Toss is a clear example. The company has said it is preparing to issue a won-based stablecoin once a regulatory framework is in place, treating legislation as the gate that determines whether the product can launch.

This push and pull is why delays matter. The longer Korea debates issuer eligibility, the more everyday stablecoin activity defaults to offshore, dollar-based infrastructure, and the harder it becomes to argue that the slow pace reflects a deliberate choice rather than lost time.

So, what happens in 2026? Scenarios under consideration include:

Staged licensing, with banks first and broader participation later, is an approach the Bank of Korea has publicly supported.

Open licensing with a “systemic” tier, where larger issuers face heavier requirements.

Bank-led consortia that are allowed but not mandatory, easing the fight over the “51% rule.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Source link - Here are Evercore ISI’s best stock picks for 2026by Dylan D. Davis

The new year is under way, and Evercore ISI has some ideas as to what their clients should buy. In a Jan. 2 note, the firm listed more than 20 stocks that could gain ground in 2026. Those include Delta Air Lines and CVS Health . The note also highlighted companies in the communications services, retail and financial services industries, among others. Evercore ISI assembled its list by compiling its analysts favorite stocks with investment horizons of 12 months or longer. These are a few of the stocks that made the cut: Delta Air Lines Delta Air Lines is poised to grow as it makes moves to improve margins, particularly amid strong travel trends, according to Evercore. “We continue to believe margin maximization is Delta’s main focus, with support from rational capacity allocation, its position as a premium high-end brand, and the strong AmEx loyalty relationship,” analysts wrote. U.S. airlines have seen improved pricing integrity and close-in demand, which should boost shares across the industry, they noted. They added that business travel is the segment with the most likely chance of improvement as policy uncertainty continues to decline. Evercore ISI has an outperform rating on Delta. It also has a $75 price target, which implies upside of 4.7% from Wednesday’s close. The stock has jumped roughly 17% over the past 12 months. CVS Health The pharmacy operator and health insurance company has room to run due to its strong long-term fundamentals, despite its plans to pull back from Medicare Advantage offerings. There is “potential upside from a variety of areas including above-market Medicare Advantage growth, new pharmacy reimbursement model, growth of the healthcare delivery business, and additional growth investments,” Evercore wrote. CVS has a cheap valuation compared to its peers, the analysts also noted. The stock trades at around 11 times forward earnings, while UnitedHealth has a multiple of 19. Evercore ISI has an outperform rating on CVS Health, as well as a $95 price target which implies upside of 19% from Wednesday’s close. The stock has risen 75% over the past 12 months.

Source link - Primary Goal for 2026 is Crypto Market Structureby Dylan D. Davis

In a year in which the United States will hold elections that could upset the balance of power in Congress, a cryptocurrency advocacy organization backed by Coinbase said its first priority is to “help get federal digital asset market structure legislation signed into law.”

In its year-in-review report released on Thursday, Stand With Crypto (SWC) said it had added 675,000 people across the US to its advocacy efforts, bringing its total to 2.6 million.

Though SWC said it would continue to mobilize its members “to support pro-crypto candidates in the congressional races” as part of the 2026 midterm elections in the US, its “primary goal” was helping the digital asset market structure bill get through Congress.

Source: Stand With Crypto The bill, called the Responsible Financial Innovation Act (RFIA) in the Senate, is headed for a markup in the banking committee next week. Lawmakers on the Senate Agriculture Committee, drafting their own version of the bill, are also expected to schedule a markup in the near future.

Market structure for digital assets, if signed into law, is expected to be one of the most significant pieces of legislation impacting the crypto industry since its creation in 2009.

The CLARITY Act, which is the version of market structure passed by the US House of Representatives in July, and drafts of the RFIA showed that the bill could give the US Commodity Futures Trading Commission more authority in regulating digital assets.

Related: If history repeats itself, will the US Congress become more pro-crypto in 2026?

Mason Lynaugh, Stand With Crypto’s community director, told Cointelegraph in November that how lawmakers vote on the market structure bill could impact their reelection bids in 2026. All 435 seats in the House and 33 seats in the Senate are up for grabs, potentially allowing Democrats to regain majority control from the Republicans.

Representatives from crypto companies gathering on Capitol Hill on Thursday

Another advocacy group for crypto and blockchain, The Digital Chamber, announced that it would be facilitating talks between members of Congress and industry representatives on Thursday ahead of the markup for the market structure bill.

Some experts are still concerned that a potential government shutdown at the end of January could slow progress on the bill.

In October, US lawmakers failed to reach an agreement on a funding bill, shutting down many federal agencies and furloughing workers for 43 days, the longest in the country’s history. The event likely slowed progress on the market structure bill in the Senate after some Republican leaders predicted it would be signed into law by 2026.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Source link - Earnings call transcript: Richardson Electronics Q2 2026 sees EPS miss, revenue beatby Dylan D. Davis

- Germany stocks mixed at close of trade; DAX up 0.01%by Dylan D. Davis

- What Top Crypto Companies Predict for Bitcoin in 2026by Dylan D. Davis

2026 could mark the clearest break yet from everything investors thought they understood about Bitcoin cycles.

For more than a decade, markets have leaned on the four-year halving model to predict peaks, crashes and recoveries.

Under that framework, 2025 should have marked the top, with 2026 shaping up as a painful down year. But a growing number of analysts now say that model is no longer reliable, and the next phase of crypto may look very different.

In a new Cointelegraph video, we break down fresh outlooks from four major crypto companies: Grayscale, Galaxy Digital, Bitwise and 21Shares, to explore what 2026 may hold.

Some forecasts are surprisingly bullish. Grayscale argues Bitcoin (BTC) could reach new all-time highs in the first half of 2026, driven by macro forces like rising global debt, fiat debasement and accelerating institutional adoption through exchange-traded products. If that happens, it would effectively invalidate the classic four-year cycle narrative.

Others urge caution. Galaxy describes the year ahead as “too chaotic to predict,” citing wide price ranges in options markets and looming uncertainties such as the US midterm elections and shifting monetary policy, even as it remains optimistic about the longer term.

Beyond Bitcoin’s price, the reports converge on several powerful trends shaping crypto’s next chapter: explosive growth in stablecoins, the rise of prediction markets tied to real-world events and increasing demand for privacy tools as crypto integrates deeper into mainstream finance.

To get the full breakdown including key data points, company-by-company predictions and the narratives most likely to define 2026, watch the complete video now on the Cointelegraph YouTube channel. And remember to like, subscribe and join the conversation in the comments.

Source link - Earnings call transcript: RPM International Q2 2026 misses EPS estimatesby Dylan D. Davis

- Exclusive-Vitol gets preliminary US license to begin negotiations on Venezuelan oil imports and exports, four sources sayby Dylan D. Davis

Exclusive-Vitol gets preliminary US license to begin negotiations on Venezuelan oil imports and exports, four sources say

Source link - Earnings call transcript: Lindsay Q1 2026 EPS Beats, Revenue Misses Expectationsby Dylan D. Davis

- China’s Anta Sports has offered to buy Pinault family’s 29% Puma stake, sources say by Dylan D. Davis

- How Scarcity Is Being Repricedby Dylan D. Davis

Key takeaways

In 2026, scarcity is being repriced through narratives, market access and financial structures rather than simple supply limits.

Bitcoin’s scarcity is increasingly mediated by ETFs and derivatives, reshaping how it is accessed and priced in financial markets.

Gold’s scarcity is tied less to mining output and more to trust, neutrality and reserve management.

Silver’s scarcity reflects its dual role as both an investment metal and an industrial input.

In 2026, scarcity has taken on a different meaning. It is no longer defined solely by limited supply or production constraints. Instead, it increasingly depends on how narratives are constructed and combined, shaping how investors perceive value.

Bitcoin (BTC), gold and silver each assert scarcity in distinct ways. However, investors now tend to evaluate them not only by how rare they are but by how they function within modern financial markets. Considerations increasingly include narrative pricing, market structure and ease of access.

This article explores how the manner in which investors discuss Bitcoin, gold and silver is undergoing change. It discusses the role of different factors in determining the repricing of scarcity.

Repricing of scarcity: A framework

Repricing scarcity does not involve forecasting which asset will outperform others. Instead, it refers to how market participants reassess the meaning of scarcity and determine how much they are willing to pay for its different forms.

In past decades, scarcity was commonly understood as a physical constraint, and gold and silver naturally aligned with this definition. Bitcoin, however, introduced a new concept: scarcity enforced by programmable code rather than geological limits.

In 2026, scarcity is evaluated through three interconnected perspectives:

Credibility: Is the mechanism that enforces scarcity considered trustworthy?

Liquidity: How readily can a position in the scarce asset be entered or exited?

Portability: How easily can the value be transferred across systems and borders?

Each of these perspectives influences Bitcoin, gold and silver in distinct ways.

Bitcoin: From self-sovereign asset to financial instrument

Bitcoin’s scarcity narrative relies on fixed, preset rules. Its supply schedule is transparent and resistant to arbitrary change. This makes Bitcoin’s scarcity framework clear, allowing investors to see precisely how coin issuance will unfold years in advance.

In 2026, Bitcoin’s scarcity and demand are increasingly influenced by financial products, particularly spot exchange-traded funds (ETFs) and regulated derivatives. These instruments do not alter Bitcoin’s core rules, but they do reshape how scarcity is perceived in markets.

Many investors now access Bitcoin not on its blockchain but through associated products such as ETFs. This shift has contributed to a reframing of Bitcoin’s narrative, from a primarily self-sovereign digital asset toward a more financialized scarce instrument. While the underlying scarcity remains fixed, pricing increasingly reflects additional factors, including liquidity management and hedging activity.

Did you know? Bitcoin’s issuance schedule is capped at 21 million units, with new supply decreasing over time through programmed halvings.

Gold’s evolution from metal to global collateral

Gold has a long-standing reputation for scarcity. Mining it requires significant investment, and known reserves are well documented. In 2026, however, gold’s value depends less on mining output and more on the trust it inspires.

Central banks, governments and long-term investment managers continue to regard gold as a neutral asset, unlinked to any single country’s debt or monetary policy. The metal is traded in various forms, including physical bars, futures contracts and ETFs.

Each form responds differently to scarcity. Physical gold emphasizes secure storage and reliable settlement, while paper gold prioritizes ease of trading and broader portfolio strategies.

During periods of geopolitical tension or policy uncertainty, markets often revalue gold based on its perceived role as reliable collateral. Investors are not always seeking higher prices. Instead, they value gold’s ability to remain functional when other financial systems face strain.

Did you know? Central banks have been net buyers of gold in recent years, reinforcing gold’s role as a reserve asset rather than a purely speculative instrument.

Why silver defies traditional scarcity models

Silver occupies a distinct position in discussions of scarcity. Unlike gold, it is deeply integrated into industrial supply chains. Unlike Bitcoin, its scarcity is not governed by a fixed issuance schedule.

In 2026, silver’s scarcity narrative is shaped by its dual-use nature. It functions as both a monetary metal and an industrial input for electronics, solar panels and advanced manufacturing. This dual role complicates scarcity pricing. Industrial demand can constrain supply even when investor sentiment is weak, while financial flows can amplify volatility despite relatively modest physical shortages.

Silver’s market structure also plays an important role. Compared with gold, silver markets are smaller and more sensitive to futures positioning and inventory shifts. As a result, silver’s scarcity often manifests through sharp repricing events.

Did you know? Silver demand is split between investment and industrial use, with industrial applications accounting for more than half of annual consumption.

The role of ETPs in reframing scarcity

One of the most significant developments influencing scarcity narratives across all three assets is the growth of exchange-traded products (ETPs).

ETPs do not change an asset’s underlying scarcity. Instead, they expand access and allow market sentiment to drive investment flows more rapidly, influencing how prices adjust.

For Bitcoin, ETPs bring a digitally native asset into traditional financial systems.

For gold and silver, ETPs transform physical scarcity into instruments that behave like stocks and respond quickly to broader economic signals.

This indicates that scarcity is influenced not only by long-term holders but also by short-term traders, arbitrage strategies and portfolio adjustments. As a result, scarcity increasingly functions as a market attribute that can be traded or hedged, rather than simply held.

Did you know? Bitcoin ETFs allow investors to gain BTC exposure without holding private keys, meaning many now “own Bitcoin” through brokerage accounts that resemble stock portfolios rather than crypto wallets.

Navigating the derivatives-driven scarcity gap

Another factor complicating the repricing of scarcity is the role of derivatives markets. Futures and options contracts allow investors to gain exposure to an asset without owning it directly. This can create an impression of abundance even when the underlying physical or protocol-level scarcity remains unchanged.

In Bitcoin markets, derivatives often play a significant role in short-term price movements. In precious metals markets, futures trading volumes regularly exceed the flow of physical supply.

These dynamics do not eliminate scarcity, but they do influence how it is reflected in prices. In 2026, investors increasingly recognize that true scarcity can coexist with high leverage and extensive derivatives activity. The key question is no longer simply “Is this asset scarce?” but rather “How does its scarcity manifest within a given market structure?”

A comparison: Bitcoin vs. gold vs. silver in 2026

This table compares how Bitcoin, gold and silver are viewed as scarce assets in 2026, focusing on narratives and market structure rather than price performance.

Scarcity vs. certainty: The investment trade-off of 2026

An emerging theme in investment circles is the distinction between scarcity and certainty. Bitcoin offers strong certainty about its future supply but less certainty around regulatory treatment across jurisdictions. Gold provides less certainty regarding future mining costs but greater certainty in terms of legal status and institutional acceptance. Silver sits between these two extremes.

This trade-off shapes how different investors interpret scarcity. Some place greater value on mathematical predictability, others on institutional reliability and still others on practical real-world use.

In 2026, scarcity is no longer viewed as a single, uniform concept. Instead, it is understood as a blend of factors, each dependent on context.

Bitcoin, gold and silver: Why every scarce asset has a role

The primary insight from this repricing process is that markets are not merely selecting one scarce asset over another. Instead, they are assigning distinct roles to each: Bitcoin, gold and silver.

Bitcoin’s scarcity is increasingly linked to portability and rule-based certainty. Gold’s scarcity is tied to neutrality and trust in settlement. Silver’s scarcity is connected to industrial demand and sensitivity to supply changes.

None of these narratives guarantees superior performance. However, they shape how capital flows into each asset, which in turn affects liquidity, volatility and overall market behavior.

In this regard, 2026 is less about determining which scarce asset emerges as the winner and more about the ongoing redefinition of scarcity itself.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Source link - TD Synnex earnings beat by $0.10, revenue topped estimatesby Dylan D. Davis

- InPost shares rise as Advent in talks with CEO, PPF on buyout – Bloombergby Dylan D. Davis

- Earnings call transcript: Constellation Brands Q3 2026 earnings beat expectationsby Dylan D. Davis

- These are the two best energy names in our Best Stocks listby Dylan D. Davis

(This is The Best Stocks in the Market , brought to you by Josh Brown and Sean Russo of Ritholtz Wealth Management.) Josh — Let’s talk about when good things happen to sleepy stocks. Typically, you’re getting a gap higher. This is because the holders have seen the news and decided they have no interest in selling, while a sudden potential change of fortune for a company is all of a sudden surfacing brand new buyers. This forms an air pocket between the prior day’s close and today’s open — we call these air pockets “gaps” and gaps are very tricky. The important thing I want you to know about gaps is that they’re like snowflakes. No two gaps are perfectly identical. You must take into account the context in which gaps appear – did they occur in an uptrend or a downtrend? Is the stock prone to gaps because of the regular impact of a lot of news flow from overseas? How meaningful is the size of the gap? Did the stock gap up above prior resistance or below prior support? What sort of volume accompanied it? Thinking through the sheer number of variables listed above (and all the variables I didn’t get to), you can imagine all the possible meanings of a stock gapping open. Your takeaway should be that there are no simple, hard and fast rules about gaps. On the Best Stocks in the Market list right now, we have a slew of energy names that gapped higher on Monday in the wake of our military operation to remove Venezuela’s corrupt dictator. People are excited about the possibility of U.S. energy companies putting in investments and infrastructure to help bring proven oil reserves of over 300 billion (!) barrels – the largest stockpile on planet earth. Sean and I are going to look at Chevron (CVX) , Baker Hughes (BKR) and Valero (VLO) — three gappy oil stocks on our radar. Best stock spotlight: Energy Sean — We’re not geopolitical experts, but we are students of price, and there has been an obvious catalyst in that sector affecting the price of energy stocks. Before the Venezuela headlines, we already had four energy names on the list: Baker Hughes (BKR), Phillips 66 (PSX) , Valero (VLO) and Exxon Mobil (XOM) . Following the energy-sector bounce tied to those developments, three additional names were added: Halliburton (HAL) , SLB Ltd. (SLB) and Chevron (CVX), the latter of which many view as the consensus beneficiary to the situation down south. For the past year, energy has been an unloved corner of the market according to our momentum screens. We don’t want to jump at the first catalyst that comes to us, and some charts look better than others, so we’ll go through the best ones to focus on from the list. Fundamentally, CVX has a number of things going on right now that the price is chewing through. First of all, Chevron bought Hess in July. The acquisition was worth $53 billion, making it one of the 10 largest energy deals in history. This gave the company access to upstream operations in the United States, Guyana and Malaysia, and operations in the Bakken shale of North Dakota. In terms of the Venezuela news, CVX is the only major U.S. oil company still operating in Venezuela under a specific U.S. sanctions license. However, Venezuela’s oil infrastructure is dilapidated and production capacity is far below historic levels, so there’s a lot of moving pieces right now. Chevron was added to the list post regime-change, but it is not one we want to focus on today. The price action looks messy, and it’ll take some time for things to play out. As Josh noted, gaps can be tricky and this is a tough one: Now onto the two best of the group… Valero Energy Corp. (VLO): Sean — Valero Energy is an oil and gas refining company. VLO is one of the largest independent petroleum refiners and operates a network of retail and wholesale oil distributors. Valero’s fundamentals have shown some volatility, but with recent improvement. After posting a net loss in Q1 FY25, the company returned to profitability with Q3 FY25 revenues of $32.2 billion and net income of $1.1 billion. Operating income has trended upward through 2025 with refinery utilization hitting 97% and utilization records in the Gulf Coast and North Atlantic regions. Josh — We’ve written about this name before, and it’s been a horse. It’s the best of the three major refiners and so long as gasoline demand remains strong, this one should keep working. Technically, investors can stay long above the recent support that’s been created at $155-$160, which was also support back in September. Traders playing this for a gap and go are already being rewarded as VLO has given nothing back since L’affaire de Venezuela that we began the week with. If they want to get cute with it, they can use the bottom of the gap ($177) for risk management but that risks an obvious whipsaw — I’d use the rising 50-day instead ($172). Remember, this is art, not science. Baker Hughes Co. (BKR): Sean — Baker Hughes (BKR) is a global energy and industrial technology company that provides equipment, services and software across oil & gas, liquid natural gas (LNG), power generation and emerging energy markets. The company has delivered a meaningful financial turnaround and margin expansion, with adjusted EBITDA nearly doubling from $2.4 billion in 2020 to $4.6 billion in 2024 and margins rising from 11.4% to 16.5%, accelerating further to a 17.7% margin in Q3 2025 as revenue climbed to nearly $28 billion. BKR also has a record $32 billion backlog for its industrial and energy technology segment. BKR has an interesting market position as it’s diversified across LNG, secular AI-power demand, decarbonization, and industrial technology capabilities, diversifying its revenues outside of pure energy. Josh — I think BKR retests the gap. The highs we saw earlier this week didn’t quite get back to the December high, which tells you there’s just not much conviction here until a material breach above $50. A strong volume close above that level and you have my full attention. If you simply must own this, $43 is your line in the sand — that’s been support since the fall. Nothing good happens below that level. DISCLOSURES: (None) All opinions expressed by the CNBC Pro contributors are solely their opinions and do not reflect the opinions of CNBC, NBC UNIVERSAL, their parent company or affiliates, and may have been previously disseminated by them on television, radio, internet or another medium. THE ABOVE CONTENT IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY . THIS CONTENT IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSITUTE FINANCIAL, INVESTMENT, TAX OR LEGAL ADVICE OR A RECOMMENDATION TO BUY ANY SECURITY OR OTHER FINANCIAL ASSET. THE CONTENT IS GENERAL IN NATURE AND DOES NOT REFLECT ANY INDIVIDUAL’S UNIQUE PERSONAL CIRCUMSTANCES. THE ABOVE CONTENT MIGHT NOT BE SUITABLE FOR YOUR PARTICULAR CIRCUMSTANCES. BEFORE MAKING ANY FINANCIAL DECISIONS, YOU SHOULD STRONGLY CONSIDER SEEKING ADVICE FROM YOUR OWN FINANCIAL OR INVESTMENT ADVISOR. INVESTING INVOLVES RISK. EXAMPLES OF ANALYSIS CONTAINED IN THIS ARTICLE ARE ONLY EXAMPLES. THE VIEWS AND OPINIONS EXPRESSED ARE THOSE OF THE CONTRIBUTORS AND DO NOT NECESSARILY REFLECT THE OFFICIAL POLICY OR POSITION OF RITHOLTZ WEALTH MANAGEMENT, LLC. JOSH BROWN IS THE CEO OF RITHOLTZ WEALTH MANAGEMENT AND MAY MAINTAIN A SECURITY POSITION IN THE SECURITIES DISCUSSED. ASSUMPTIONS MADE WITHIN THE ANALYSIS ARE NOT REFLECTIVE OF THE POSITION OF RITHOLTZ WEALTH MANAGEMENT, LLC” TO THE END OF OR OUR DISCLOSURE. Click here for the full disclaimer.

Source link - Ethereum is Linux for the Open Internet of Valueby Dylan D. Davis

The Ethereum network, a decentralized layer-1 blockchain that executes smart contracts, is analogous to the open-source operating system Linux, according to Ethereum co-founder Vitalik Buterin.